Yearend checklist for small businesses

It’s almost time to file your 2019 taxes.

One month into the New Year, and we’re wondering… how have you reflected and learned from the previous one… the good, the bad, and the ugly. Reflecting on all aspects of your business will help you identify areas for improvement and set realistic goals for 2020. This is a good time to get up-to-date on anything that may have taken a backseat, to clean-up, clean-house, re-energize, and re-focus.

We also have the same question on our mind; how do we minimize the taxes we have to pay?

Before we get to taxes, here are 4 End-of-Calendar-Year Business Best Practices for you to go through:

1. Clean client and vendor lists.

- Go through your contacts database and make sure everybody’s details are correct and current.

BONUS: While you’re doing this, send a thank-you email and remind them you’re there for them whenever they need you!

2. Review employee information.

- Go through your employee records and remove old employees from your active payroll to ensure no errors may occur in the future.

BONUS: If you haven’t already, this may also be the right time to consider employee bonuses or review employee contracts. After all, our teams all are critical to our success, and retaining your top talent should be a priority.

3. Look over your insurance policies.

- Who handles your insurance policies? Reach out to see if they have any new recommendations. In some cases, you may even want to talk to other insurers – in case a better deal exists for you. Be sure to have all your statutory and recommended insurance covered.

4. Reflect on goals and encourage your teams to do the same.

- Did you reach them? Did you fall short?

- What goals are you setting for the new year?

- Did you achieve everything you intended to last year? If so, great. If not, try to find out why. Making goals for the coming year can help keep you motivated as your business grows. Review them regularly to stay on track.

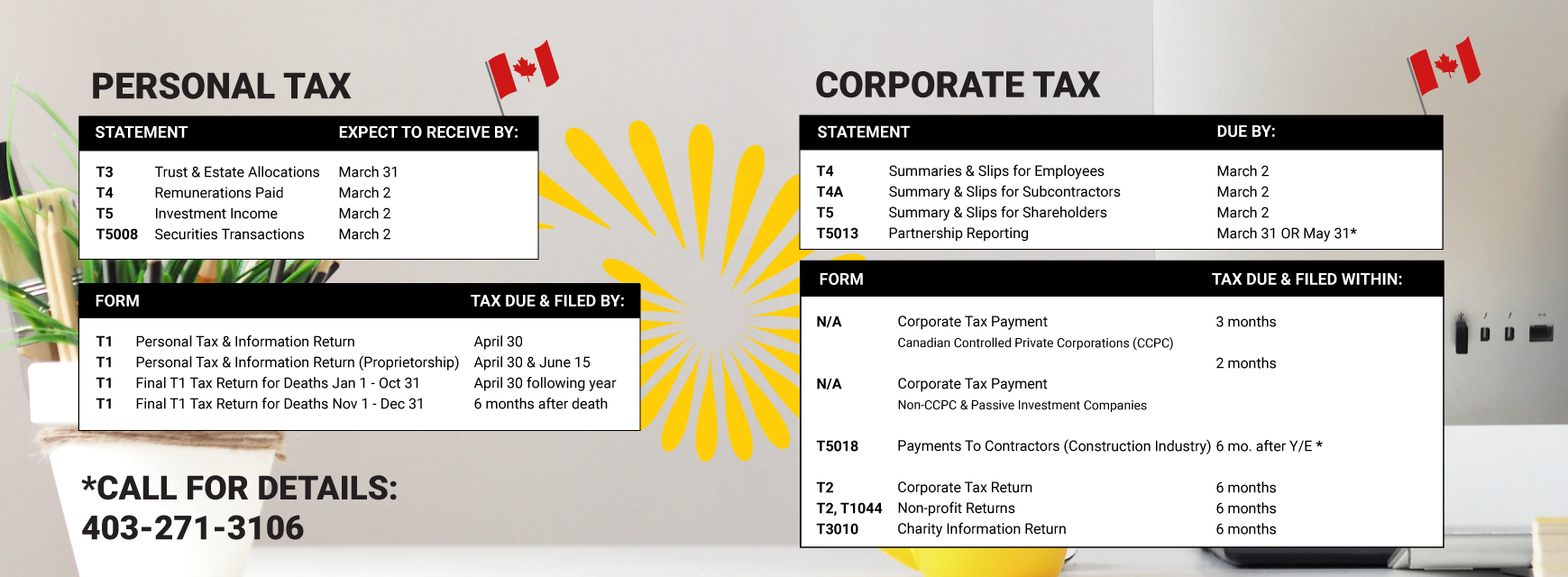

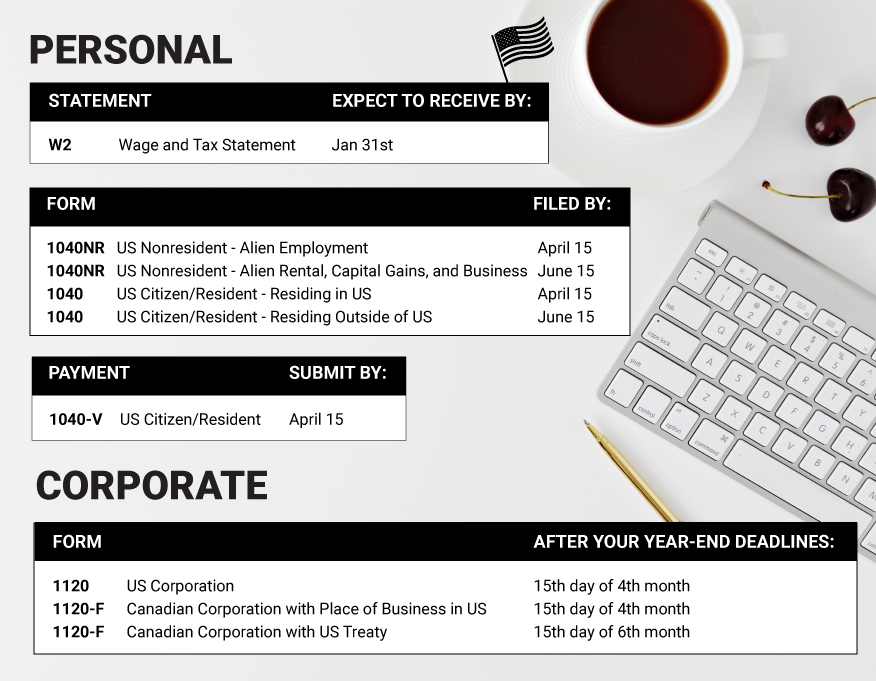

Now, moving onto taxes, here is a look at Important Tax Deadlines in Canada and the USA for personal and corporate tax documents and returns:

Canada:

USA:

And, without further ado, here’s our ‘Pay Less Corporate Tax’ Cheat Sheet:

What you SHOULD be doing regularly:

1. Use accounting software to your benefit; to accurately estimate how much tax you will have to pay. If you aren’t already doing this, switch to an accounting software now!

- Accounting is the language of business, and successful business leaders are fluent in it. With online accounting software, there is no excuse to inaccurate books.

- Just like many modern-day accountants, Achen Henderson uses various online tools to ensure our clients have access to up to date and accurate information.

2. Books are CLOSED within 15-days of month-end

- Have a plan to pay all your accounts payable to keep your vendors happy!

- Reconcile your books and review the details of every account to make sure they make sense. Sales, Accounts receivable, Accounts payable, Shareholder loan account, Expense amounts and categories, Reasonableness.

3. Use your cash reports to understand how much cash you have on hand

- As you know, cash is king! Understanding your business’s cash flow is a key to success!

- Cash flow can mean the difference between you taking that holiday this year, or missing debt payments. It can make or break your operations.

- Get help to generate realistic cash flow forecasts for the next 12 and 24 months.

What you SHOULD do at your Year-End:

1. Confirm all your tax deadlines…

- Confirm all your tax deadlines *Note Above Infographics*

- Late penalty fees can add up, so be proactive and contact the CRA to see what they can do for you if you think you might be late.

- Set up a calendar of deadlines in your web calendar to remind you when to take action.

2. Year-end books are CLOSED, reviewed, and delivered to your accountant within 30-days of year-end.

3. Prepare your payroll records

- Good accounting software should do this for you. We love cloud-accounting and payroll platforms!

- One benefit is accurate payroll records. Save time compiling records with the right payroll software, and of course, ask your accountant if you have any issues.

- Make sure you comply with all payroll regulations – including any recent changes.

4. Set a meeting with your bookkeeper, accountant, financial advisor.

- Prepare a list of questions to ask your financial advisor. What is currently confusing you? What can you do better next tax season?

- If you work with Achen Henderson, you know that we communicate with you throughout the year and provide you with the lists of tasks and documents we need from you.

- However, if you haven’t talked to your accountant since last tax season, then you’ll need to make an appointment to get the process started! Reach out to help them focus on your business at this busy time of year.

What you can do next Year-End to help yourself next year:

1. Scrutinize your balance sheet and P&L report for what you did well – and what you didn’t. Ask your accountant for help interpreting the results.

Business performance metrics should be looked at regularly. With year-end fast approaching, this is something you want to keep an eye on what didn’t work to improve your operations. Your assets, liabilities, and statement of cash flows will give you a good idea of where you stand. Maintaining clean accounting records is key to getting these kinds of reports when you need them.

Check out your income statement to see your profitability. Your income statement will list each revenue-generating item, along with your expenses. It’s a useful way to see your profit and loss for the year and to make considerations surrounding expenditures for the next year. Have you made the most of tax-deductible expenses? Were you better off paying dividends or salary? What might you want to do differently next year?

All good questions to ask your accountant…

2. Add up your quarterly estimated tax payments for the year

- Keep track of your quarterly estimated tax payments from the year as they will help you estimate what you owe for year-end.

- By doing this, you will avoid paying interest and penalties and spending money you don’t have.

BONUS: PERSONAL TAX TIPS

- Keep an eye on your TFSA and RRSP contribution limits, and make contributions if that is a part of your investment strategy (talk to your investment adviser)

- Keep all of your medical and health-related receipts

- Keep all of your charitable donation tax receipts

- If you are invested in trusts, such as mutual funds, delay completing your personal taxes until April, as T3s often aren’t received until the first few days of April and you don’t want to miss reporting any income on your personal tax return!

OF COURSE, YOU CAN ALSO USE AN EXPERT TO PREPARE AND FILE YOUR TAXES FOR YOU.

We’re a call or click away.